Fast Finance Made Easy

High Rate of Approvals

Transparent Guidance

Effortless Experience

Finance Facilities up to 1 Million

Secure your car financing quickly with SmallBiz Fleet Finance

Speedy Car Financing

Vehicle & Profile

Share the specifics of the vehicle you want and your personal details to get started.

Provide Your Details

Loan Match

Smart Matching with Lender comparison

We analyse your profile against lenders to find the best match without impacting your credit score.

Get Approved

Get Your Approvals Quickly

Get approved within 2 hours or up to 2 days, depending on your chosen finance provider.

Drive Away

Complete Ownership

Finalise the paperwork, claim immediate ownership, and drive your vehicle home.

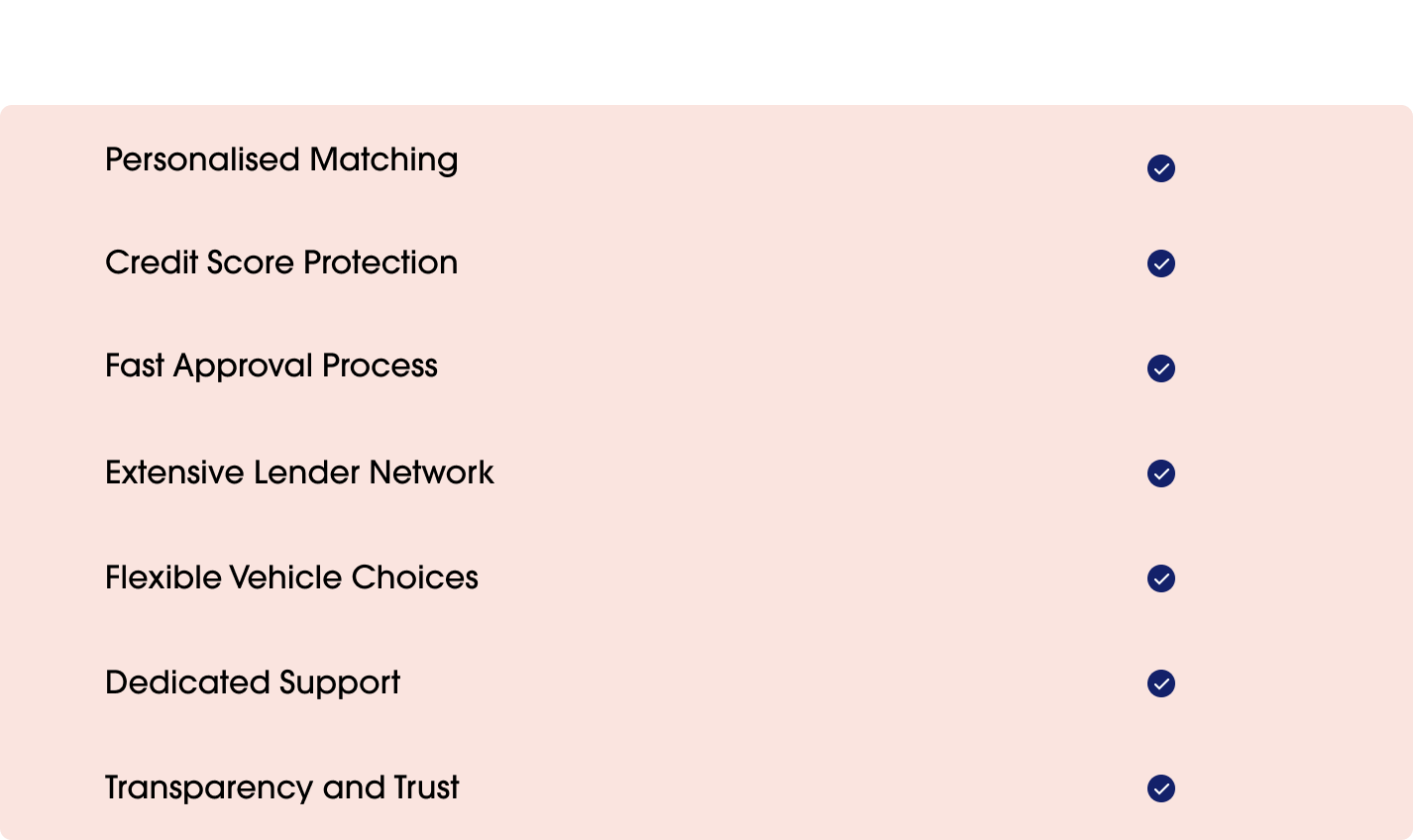

Why We Stand Out?

Effortless Loan Securing for Your Fleet Needs

Top Reasons to Secure Car Financing with SmallBiz Fleet Finance

Discover why SmallBiz Fleet Finance is the best choice for your car loan needs.

-

Finance options allow you to choose higher-quality vehicles that may otherwise be unaffordable.

-

Timely repayments help to establish and improve your business credit score.

-

Maintain your business' cash flow by spreading the cost of the vehicle over time instead of paying upfront.

-

Interest payments on car loans may be tax-deductible, reducing overall tax liability of your business.

-

Tailored repayment schedules that fit your businesses' financial situation and cash flow.

Ready to Drive Your Business Forward?

Finance

Lease: Flexibility & Control

Finance leasing offers a flexible way to acquire a vehicle without the need for upfront payment. With this option, you lease the vehicle for an agreed period, making regular payments while enjoying full use of the car.

Chattel Mortgage: Ownership and Tax Benefits

A chattel mortgage allows you to purchase a vehicle with the help of a secured loan, where the vehicle itself serves as collateral. This option offers immediate ownership, with the lender holding a mortgage over the vehicle until the loan is fully repaid.

Have Any Questions?

-

If you're using the vehicle for business purposes, you might be eligible to claim a tax deduction on the loan interest charges. Additionally, you can claim the depreciation value of the vehicle, up to the Depreciation Limit established by the Australian Taxation Office (ATO). For detailed advice tailored to your situation, it's best to consult your accountant.

-

A chattel mortgage is suitable for both businesses and individuals, provided the car is primarily used for business purposes. This financing option is especially beneficial for those registered for GST on a cash accounting basis, as you can likely claim the GST from the vehicle’s purchase price as an Input Tax Credit on your next Business Activity Statement.

-

Similar to a secured car loan, the lender provides the funds for you to purchase the vehicle, and you take ownership at the time of purchase. The lender holds a 'mortgage' over the vehicle as security for the loan. Once you complete the contract, you will own the vehicle outright.